Irs w4 estimator

You no longer claim 2016 Tax Refunds. The redesigned Form W-4 makes it easier for you to have your withholding match your tax liability.

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

For more information see section 7872 and its related regulations.

. Fill out Form ID W-4 with that information. But if you prefer to have more tax than necessary withheld from each paycheck you will get that money back as a refund when you file your tax return keep in mind though you do not earn interest on the amount you overpay. Select your states and download complete print and sign your 2016 State Tax Return income forms.

Individuals who have insufficient income tax. The AFR is established monthly and published by the IRS each month in the Internal Revenue Bulletin. PAYucator - Paycheck W-4 Calculator.

IRS 1099 Form Explained Everything You Need To Know. Use page 2 of the Form ID W-4 to estimate your Idaho withholding. If you have concerns with Step 2c you may choose Step 2b.

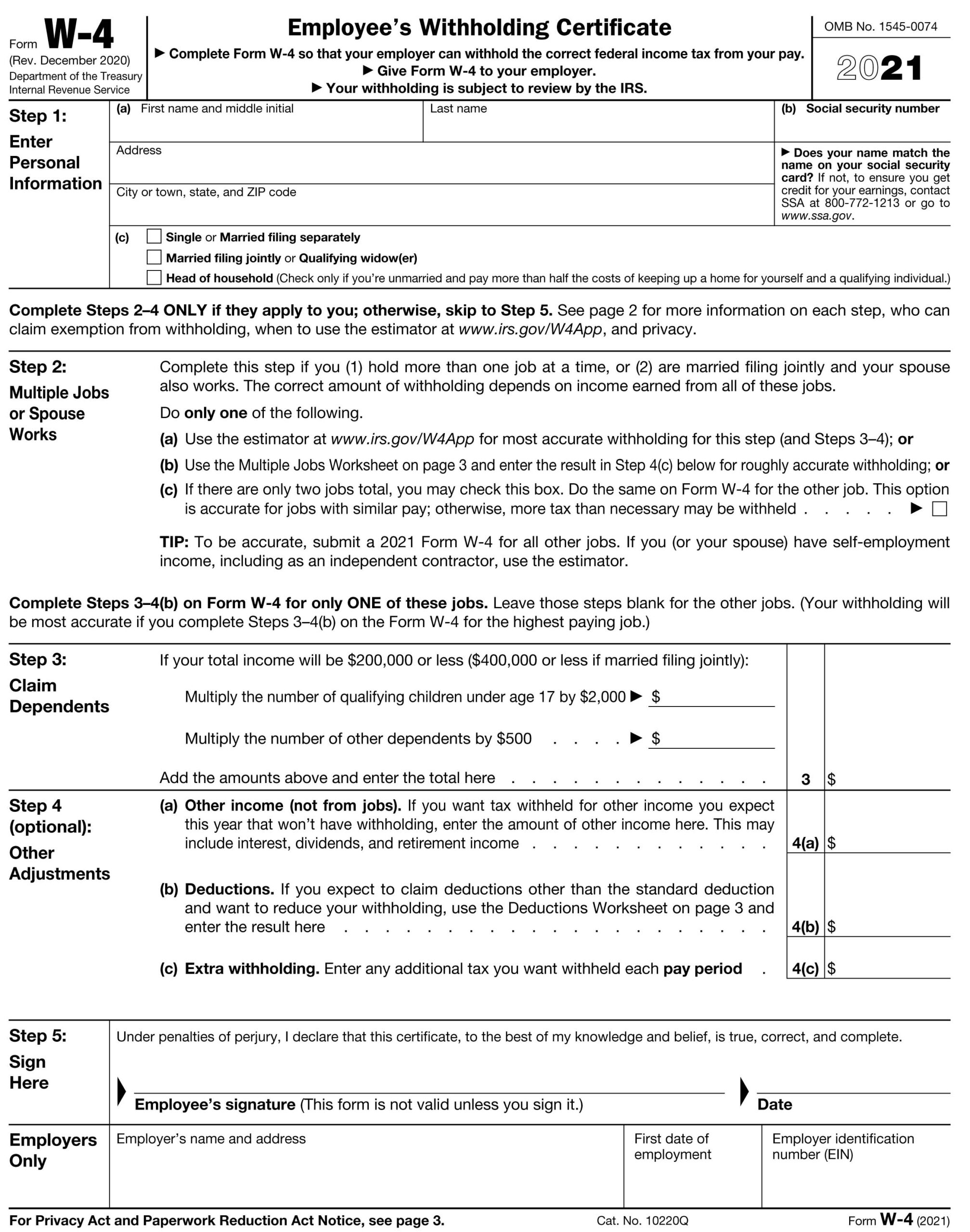

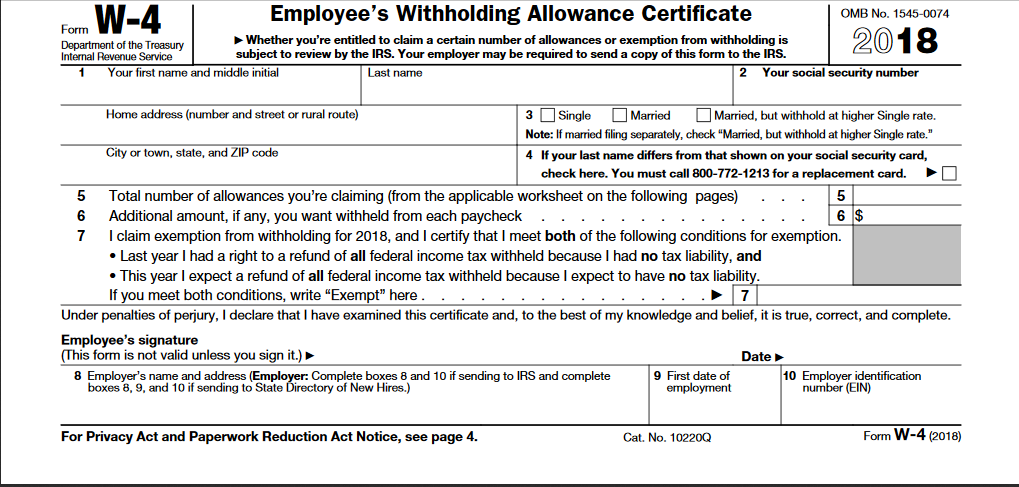

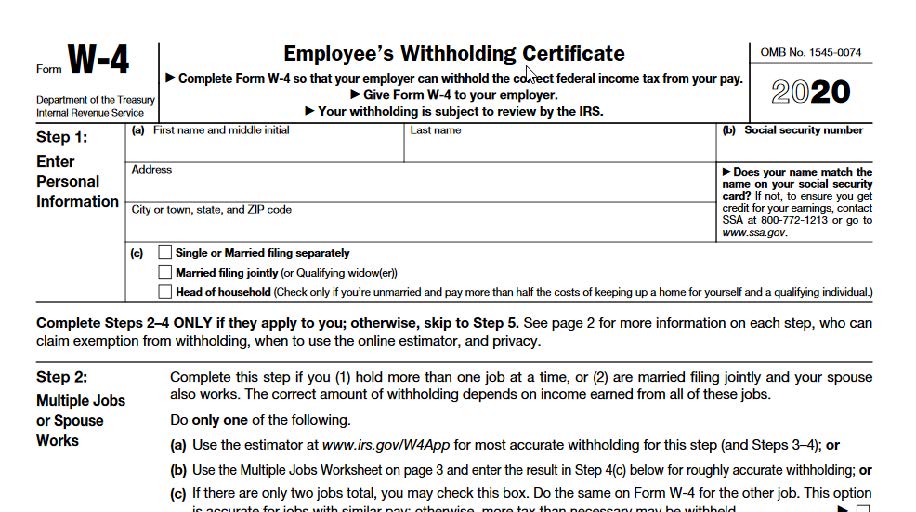

What to keep in mind when filling out Form W-4. The IRS redesigned Form W-4 in 2020 and did away with the ability to claim personal allowances. W-4 Adjust - Create A W-4 Tax Return based.

Previously a W-4 came with a Personal Allowances Worksheet to help you calculate what allowances to. The W-4 form has changed. 6 to 30 characters long.

In order to file a 2016 IRS Tax Return download complete print and sign the 2016 IRS Tax Forms below and mail the forms to the address listed on the IRS and state forms. The IRS urges taxpayers to use these tools to make sure they have the right. If there are more than two jobs use the Multiple Jobs Worksheet on page 3 or the estimator to ensure you are withholding enough.

Include it in compensation on Form W-2 or Form 1099-NEC for an independent contractor. If this is the. Once you have your numbers then you can plug them into the form.

The Tax Withholding Estimator doesnt ask for personal information such as your name social security number address or bank account numbers. Steps 2 through 4 use the online estimator which will also increase accuracy. Steps 2 through 4 use the online estimator which will also increase accuracy.

For details on how to protect yourself from scams see Tax ScamsConsumer Alerts. If you have concerns with Step 4a you may enter an additional amount you want withheld per pay period in Step 4c. What Retirees Need to Know about the New IRS 2020 W-4 The Tax Cuts and Jobs Act of 2017 brought many changes some of them quite recently.

Another useful resource Publication 505 Tax Withholding and Estimated Taxes is available on the IRS website or can be obtained by calling 800-TAX-FORM 800-829-3676. For single filers Form W4 is filled out the same way as any other employee with any other filing status. IR-2018-36 February 28 2018.

On Part 1 of 2021 Form W4 select your filing status as Single or Married filing separately and enter the rest of the personal information asked. Use our handy Guide to the New W4 for a visual. 2022 Form W-4 Multiple.

Update the federal Form W-4 with that information. Form W4 Part 2 and Part 3 for Single Filers. RATEucator - Income Brackets Rates.

As an alternative to the estimator. The actual IRS tax return mailing address including UPS FEDEX options will be based on the state or territory you currently live or reside in and on the type of Form 1040 that you are filing and whether you expect a tax refund or submitting a tax. If you fill out Step 3 multiply the number of children under age 17 by 2000 and put the amount on the line.

ASCII characters only characters found on a standard US keyboard. As an alternative to the estimator. Use the withholding estimator at IRSgov to estimate your federal withholding.

For all other dependents multiply. The IRS advises that the worksheet should be completed by only one of a married couple the one with the higher-paying job to end up with the most accurate withholding. You can get these rates by visiting IRSgov and entering AFR in the search box.

The IRS withholding estimator - this is the most accurate way Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4c for roughly accurate withholding If there are only two jobs total you may check the box in 2c. The IRS Tax Withholding Estimator is available to help employees determine the proper amount of federal income tax withholding. 2022 Tax Calculator Estimator - W-4-Pro.

Must contain at least 4 different symbols. The IRSs W-4 estimator or NerdWallets tax calculator can also help. One is that the Internal Revenue Service IRS issued a new 2020 IRS Form W-4 that is quite different from previous Form W-4s.

W-4 Pro Select Tax Year 2022. If you have concerns with Step 2c you may choose Step 2b. The 2022 eFile Tax Season for 2021 Tax Returns starts in January 2022.

Form W4 Part 1. If this is the. If you have concerns with Step 4a you may enter an additional amount you want withheld per pay period in Step 4c.

WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help taxpayers check their 2018 tax withholding following passage of the Tax Cuts and Jobs Act in December. We dont save or record the information you enter in the estimator. To ensure that you get the best refund or even just a tax break first get your accurate numbers by using the online IRS Withholding Estimator a couple of times a year and adjust your W-4 as your earnings fluctuate.

IRS tax forms.

Irs Releases An Early Draft Of The 2020 W 4 Erp Software Blog

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

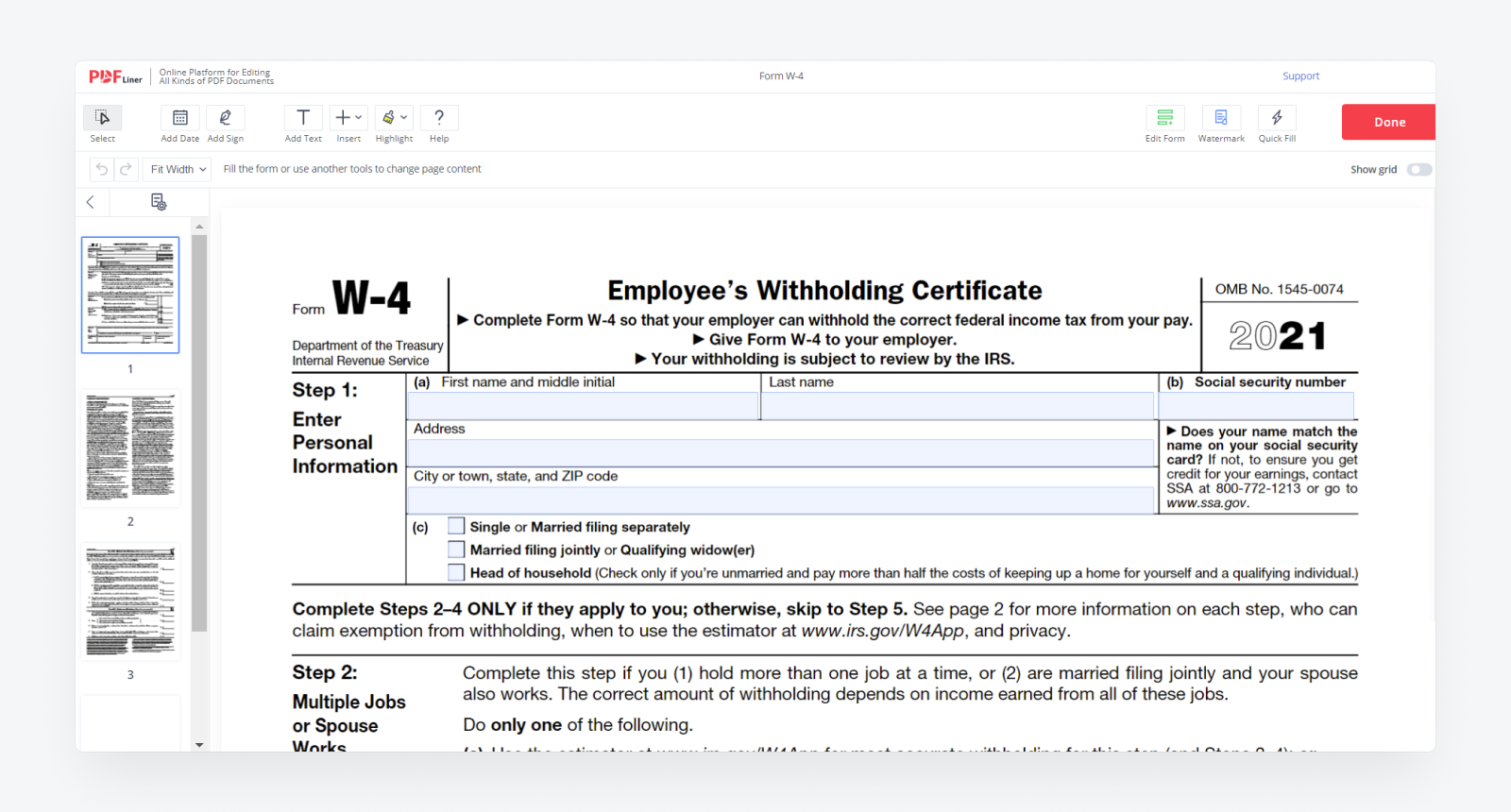

How To Fill Out 2021 2022 Irs Form W 4 Pdf Expert

How To Use The Irs Withholding Tax Estimator For Form W 4 Youtube

Form W 4 Employee S Withholding Certificate 2021 Mbcvirtual In 2022 Changing Jobs Federal Income Tax Internal Revenue Service

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

W 4 Form Basics Changes How To Fill One Out

Tax Forms Easy Tax Store

How To Use The Irs Withholding Tax Estimator For Form W 4 Youtube

Irs Releases New 2018 W 4 Form

The New Irs Form W 4 Has Many Scratching Their Heads Here S What You Should Know Komo

How To Get A W 4 Form And Which Steps To Take

How To Fill Out Irs Form W 4 2020 Married Filing Jointly

E Alert Irs Issues 2020 Form W 4 Hr Knowledge

Irs Improves Online Tax Withholding Calculator

What Is Irs Form W 4

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Komentar

Posting Komentar